June was an especially challenging and turbulent month with the twelve-day war in Iran. Because of the war, West Texas Intermediate (WTI) oil prices for June exceeded the high end of my target range of $67.50. Now that the war is behind us, I expect WTI to range between $60 to $70 per barrel for July.

I will share some of the news items during the past month that have influenced my thinking. On May 31, the Financial Times published “Opec+ to boost oil output for third consecutive month” (subscription required).

Opec+ announced another large increase in oil output for July in the latest sign that the cartel was intent on unwinding the first tranche of its long-standing production cuts as quickly as possible.

Eight members of the oil-producing group, including Saudi Arabia and Russia, said on Saturday that they would increase headline production in July by a combined 411,000 b/d.

The decision to fast-track the return of idled capacity for the third consecutive month means the group could add as much as 1.4mn b/d to the global market between April and the end of July.

Like many others, I expect another headline in early July saying that production will be increased by another 411 kbd for August.

Another article by the Financial Times on June 2 “Saudi Aramco raises $5bn in bond sale as it grapples with lower oil prices” (subscription required) hints that lower prices might be here to stay for a while.

Saudi Aramco, the world’s largest oil company, said on Monday it had raised $5bn in a bond sale as it positions for a downturn in oil prices and prepares for further borrowing.

Aramco said demand for the three sets of bonds it issued in London had been “strong”, with coupons ranging from 4.75 per cent to 6.375 per cent.

The issuance was one of the largest in London so far this year, after the Public Investment Fund, the Saudi sovereign wealth fund, tapped the debt market for $4bn in January, and UK building society Nationwide sold €3.25bn and £1bn of bonds during the first quarter.

One of the many people that I admire and follow on X is Gary Ross.

He was more bullish than I was prior to the war.

On June 4, Bloomberg published a short article “Saudi Arabia Wants More Super-Size OPEC+ Hikes” (subscription required).

Saudi Arabia wants OPEC+ to continue with accelerated oil supply hikes in the coming months as it puts greater importance on regaining lost market share, according to people familiar with the matter.

The kingdom, which holds an increasingly dominant position within OPEC+, wants the group to add at least 411,000 barrels a day in August and potentially September, the people said, asking not to be named because the information was private. Riyadh is keen to unwind its cuts as quickly as possible to take advantage of peak demand during the northern hemisphere summer, one person said.

Although I agree with the 411 kbd increase, I am less confident of the rationale.

On June 10, the Financial Times published “US oil output set for first annual drop since pandemic” (subscription required).

US oil production will fall next year for the first time since the Covid-19 pandemic, according to a government forecast that will cast new doubt on Donald Trump’s “energy dominance” agenda.

The Energy Information Administration, a division of the energy department, on Tuesday said US oil production would drop from a record high of 13.5mn barrels a day now to about 13.3mn barrels by the end of next year, as slumping oil prices rattle the sector.

“With fewer active drilling rigs, we forecast US operators will drill and complete fewer wells through 2026,” the EIA said in a monthly report published on Tuesday. Active rigs had “decreased by much more” than expected in a previous report, it said.

This development adds to the bullish sentiment.

Another June 10 article, this one from the CBC “OPEC boss slams net-zero targets, promotes big future for oil in Calgary speech” (free access) suggests that demand for oil and gas has a long horizon.

“Simply put, ladies and gentlemen, there is no peak in oil demand on the horizon. The fact that oil demand keeps rising, hitting new records year on year, is a clear example of what I’m saying,” he said in his speech.

Primary energy demand is forecast to rise by 24 per cent between now and 2050, he said, surpassing 120 million barrels of oil a day. Currently, oil demand is around 103 million barrels per day.

“Meeting this ever-rising demand will only be possible with adequate and timely and necessary investments in the oil industry,” he said, pointing to the need for $17.4 trillion US in investment over the next 25 years.

In contrast to the CBC article, the Financial Times published “Big Oil faces up to its sunset era” (free access) where the title suggests that the industry is dying.

Oil majors are no strangers to boom-and-bust cycles. But now the challenge may be structural. The rapid adoption of electric vehicles, especially in China, has surprised the industry. Many oil majors now concede that their production will probably peak within the next decade.

“There’s no doubt that in the grand scheme of things, this is a sunset industry,” says Paul Gooden, head of natural resources at asset manager Ninety One. “We can debate how far the sunset is away, but companies need to recognise that — and increasingly they are recognising that.”

László Varró, Shell’s head of scenario planning, echoes the sentiment. “There is very little doubt that peak oil demand is coming,” he says.

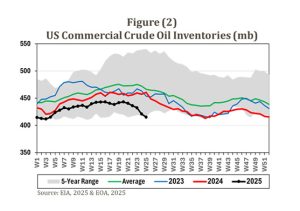

The US Commercial Crude Oil Inventories (MB) chart comes from Dr. Anas Alhajji’s subscription-based Daily Energy Report.

Because oil inventories have broken below their five-year range, I am moderately supportive of oil prices. The macroenvironment still looks challenging; however, oil inventories are low and trending lower.

I deliberately avoided discussing the war in Iran. Numerous media organizations covered it extensively, and I am hoping that because the war is behind us, we are back to normal oil markets.

Switching topics, I want return to an earlier period in June when there were a lot of pessimistic price outlooks. Some investment banks were calling for Brent prices to remain in the low $60s for the remainder of the year.

I am going to mention two individuals that have been or are bearish, comparatively speaking, on the oil price outlook. Even though their views are different than mine, I have great respect for both individuals. If I mention someone in my articles who takes an opposing view to mine, it is usually because I respect their viewpoints and want to allow others to consider those viewpoints. If I do not have respect for someone’s outlook, I simply do not mention them, regardless of whether I agree with them.

As I mentioned last week, it is rare that I have a more bullish outlook than Eric Nuttall. Here is his latest YouTube which was published on June 5 before the war in Iran:

On June 2, Paul Sankey from Sankey Research provided some bearish comments on CNBC. You can follow through his X post to CNBC to watch the video:

And then on June 11, Sankey provides more context to his CNBC comments in a YouTube video:

I found his YouTube presentation quite interesting and informative.

Overall, I am moderately supportive of slightly higher prices for July. As mentioned at the outset, I expect WTI to range between $60 to $70 per barrel for July. Although I am moderately supportive of oil prices for July, I am less sanguine about oil prices in the fourth quarter. As we get close to the fourth quarter, I may revise my outlook.

Disclosure: Short strangle (short calls and short puts) on WTI futures.

Recent Comments