I am increasing my March West Texas Intermediate oil price forecast by $2.50 to range between $60 to $70 per barrel for April 2021.

Last month was a particularly volatile month. Oil prices fell below and rose above, at least on an intraday basis, my March forecast of $57.50 and $67.50. And in the last few days of trading, oil prices have been bouncing around between $57.50 to $61 per barrel. I would not be surprised if that pattern continues into early April.

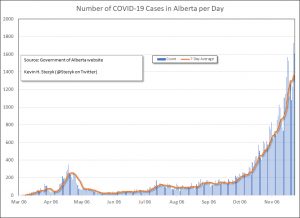

But as time marches forward, I continue to expect that prices will move higher. As vaccinations increase and warmer weather encourages people to spend more time outdoors, the number of COVID-19 cases should at least stabilize, if not decrease, and people will likely grow increasingly confident of the future where they begin making plans to travel.

COVID-19 cases are still a concern. This past weekend, the Financial Times (subscription required) ran an article “Europe warns hospitals at ‘breaking point’ as third Covid wave hits” where several countries, including Germany, Poland, and France, are struggling to contain the latest outbreak.

European governments have warned that their hospitals are at risk of being overwhelmed by Covid-19 cases as leaders struggle to get a grip on the pandemic after a week of ill-conceived lockdown measures and recriminations over the EU’s slow vaccine rollout.

German health authorities on Friday warned that the third wave of coronavirus infections could be the worst, pushing intensive care units to “breaking point”.

Lothar Wieler, head of the Robert Koch Institute, the government agency leading the fight against the pandemic, said stopping the wave was impossible but he called on people to reduce contacts to prevent spiralling infection rates.

So the path forward will not be smooth sailing. Although progress will be made, setbacks are bound to occur. That notwithstanding, countries in the northern hemisphere are likely to be in a better position a month from now than they are today.

Do not forget, too, that the markets are forward looking. So even if the progress is marginal, the general public and investors will be looking toward summer when they expect people to be more active.

OPEC+ has its meeting on April Fool’s Day. While I expect it to roll over its current quotas, there is always the potential for a surprise.

Wrapping up, while I would not be shocked to see some weakness in prices in early April, I expect prices to firm as the month progresses. If countries make significant progress in vaccinating their populations, then higher prices may be warranted toward the end of April.

Recent Comments